Earlier this month, #Zwift – the leading virtual and multiplayer online trainer for running and cycling – announced a $450 million Series C investment round. With the round, Zwift officially earned the status of a unicorn. Following that round, many of you approached us to understand more what is behind this valuation and with this article we wanted to share some of AST’s thoughts on what lead to this #Phygital unicorn status for Zwift.

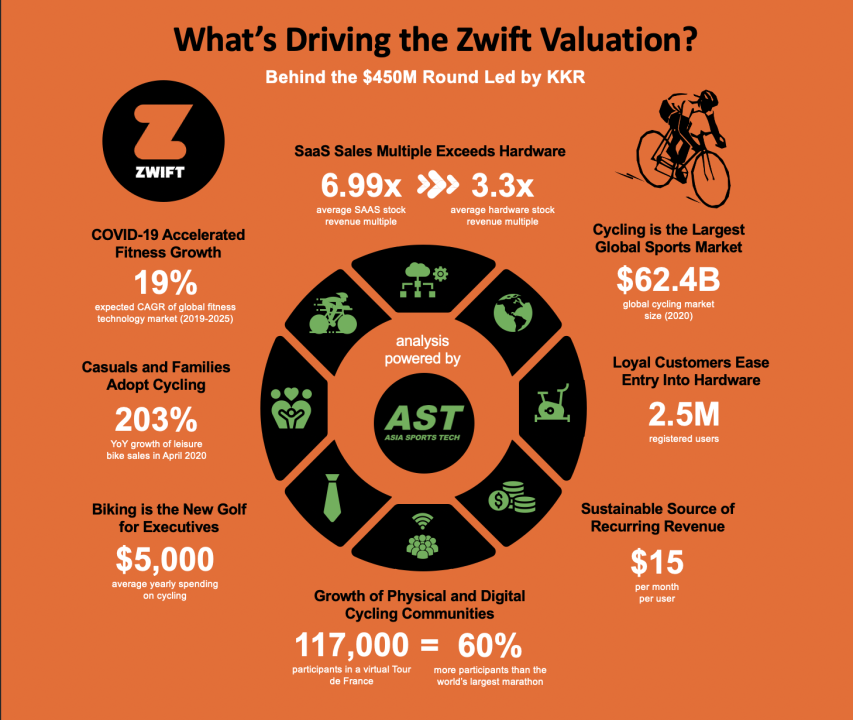

The growth of the entire biking industry is one core driver behind Zwift’s valuation. Cycling was already the largest global sports market before the COVID-19 pandemic, worth $62.4 billion in 2018 according to NPD Sports. In fact, it is one of the sports sectors that has benefited the most from the pandemic and worldwide social distancing measures, as people stuck at home search for activities to stay active and healthy with activities like Zwift or Peloton and as soon as the population was allowed to go out again many have opted to commute by bicycle than public transport. The pandemic has effectively accelerated the growth of cycling, as bicycle sales grew 75% year-on-year (YoY) from last April in the US market alone. The lockdowns also meant that more casual users and families began cycling more, with leisure bicycles in the US growing 203% YoY from last April.

With the increased adoption of cycling, different users are trying it out and new communities are being built around the activity. In particular, executives (especially C-levels) have been cycling more and more. Biking has been touted as the “new golf”, with the popularity of golf declining globally and cycling’s superior flexibility and efficiency over golf (which takes more hours to do opposed to biking). Executives translate into a high-spending customer segment, who can easily justify paying US$20,000 on a full road bike and kit set.

SaaS Business Model brings Valuation to New Levels

As a company, Zwift’s subscription software as a service (SaaS) business model means users pay subscription fees to be able to use their service. This provides the company with a sustainable source of recurring revenues, with their customers paying $15 per month – with room to grow. This is a major difference from competitors in the hardware category, who are more reliant on continued sales of their equipment while amassing inventory costs. The sustainability of SaaS business models has naturally translated into higher stock multiples, with average SaaS stocks having a price-to-revenue multiple of 6.99x compared to hardware companies’ 3.3x.

Peloton experienced significant growth during the pandemic, with market capitalisation and price-to-sales ratio skyrocketing in the past 6 months.

A SaaS company entering Hardware Business

However, Zwift is also planning to add on to its product offering by jumping into the hardware sector and selling its own equipment – with the strategic investment from #Specialized in this round. This “hybrid” software and hardware product offering would be similar to #Peloton’s (NASDAQ: PTON), who traditionally provide stationary bikes and have delved into offering fitness classes for subscribers. During the pandemic, Peloton achieved impressive growth, mostly due to the growing popularity of fitness technology and exercising from home. From 31st March to 23rd September this year, their market capitalisation grew almost four times from $7.5 billion to $27.5 billion and their price-to-sales ratio grew almost three times bigger from 14.2 to 36.8.

A very engaged community of Zwifters

Peloton’s success should give a strong indication of Zwift’s optimistic future potential. Zwift’s strong and loyal customer base could also ease entry into the hardware market. With an existing community of 2.5 million registered users (that will only continue to grow as physical communities adopt online channels and users find cycling groups online amidst the pandemic), Zwift users have shown an unmatched enthusiasm for biking. 117,000 users participated in a virtual Tour de France held by Zwift in July, which is 60% more participants than even the Hong Kong Marathon (the world’s largest marathon on a participant basis).

Ride On!